Why is an NFT so Expensive?

A NFT, or non-fungible token, is a computerized resource that contains exceptional information about different information (metadata) and exists on a blockchain (generally principally the Ethereum blockchain). Advanced portrayals of fine art, music, recordings, properties, and gaming things, NFTs are by and large traded with digital forms of money. They're unmistakable from digital currencies in light of the fact that each NFT is special and can't be traded for another. This trademark gives NFTs their non-fungibility.

Presently, we should discuss fungible things. Dissimilar to non-fungible tokens, fungible resources aren't extraordinary, and that implies you'll have the option to find and trade comparative fungible things and hold a similar worth. For instance, in the event that you have a dollar note and exchange it for another dollar greenback, you'll in any case wind up with $1. Digital currencies are fungible tokens, creating them replicable things that clients can trade. They're likewise distinct. One bitcoin, for instance, notwithstanding being worth a great many dollars, can be parted into various divisions that can likewise be traded.

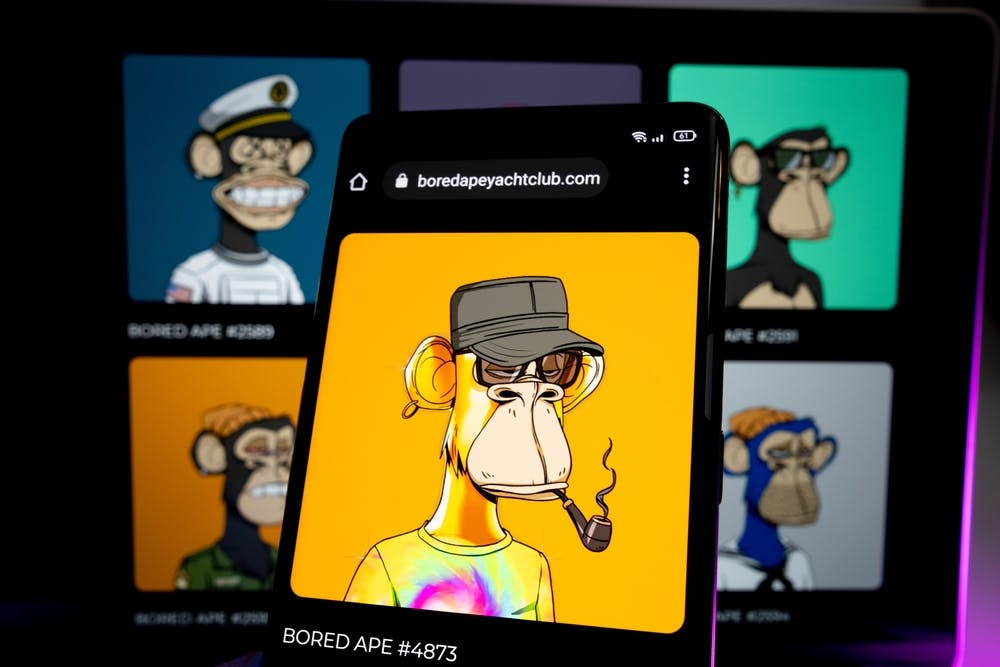

NFTs arrive in a genuinely wide cost range. You can track down NFTs on different commercial centers at modest valuations, while others can go up to large number of dollars. What's more, in all honesty, the most costly NFTs have sold for a huge number of dollars. Yet, what makes some NFTs so costly? A few elements give NFTs their worth, including:

Last refreshed

November 29, 2022

Share

Leap to segment

Shortage

Legitimacy

Composability

Utility

All in all, for what reason are some so costly?

Shortage (now and then alluded to as "lack") is an essential part of financial matters. It alludes to the divergence between supply (restricted assets) and request (hypothetically boundless needs). Society should judge how to disperse assets successfully to address crucial issues and further cares about.

All in all, how is shortage pertinent to NFTs? Each NFT is one of a kind, and there's only one of each accessible. This makes them scant, subsequently expanding their worth per unit of interest. As a matter of fact, explicit assortments of NFTs send off in restricted amounts, and that implies their worth will rise once they're completely sold as there won't be any more NFTs left to buy.

The most well known illustration of this is the CryptoPunks project, where there were just 10,000 remarkable cryptopunks. Every troublemaker has a blend of similar kinds of traits (i.e., hair, eyes, and skin tone), with a portion of these properties more extraordinary than others, making some cryptopunks more costly than others. Other NFT projects have replicated this assortment discharge with shifting credits with a restricted inventory strategy.

Another model, Axie Endlessness, a web-based computer game with NFTs, is notable for its crypto-situated in-game cash framework. The game has advanced pets known as Axies that players gather and mint. Each time a player purchases an Axie pet, the likelihood of them securing a more extraordinary Axie increments. These computerized pets have more uncommon qualities and characteristics, placing them in a unique case class of their own. Thus, the cost of Axie NFTs shoots up and brings high valuations for their makers.

Comments

Post a Comment